Give

Funds at the Foundation support a number of different causes and community organizations, so your donation can impact the causes and support community legacies that mean the most to you. Whether it be a gift to a scholarship fund that supports area students, a donor designated or donor advised fund to impact an area of need or an agency endowment supporting vital community organizations, your gift makes a difference. Join the over 1,900 donors who trust CRCF as a faithful steward of their contributions ever year and be apart of Growing Good in the Cattaraugus Region.

The Foundation accepts donations by check and credit card as well as gifts of stock, IRA rollovers and similar contributions from other retirement plans. A gift to a fund at the Community Foundation is a gift to the community. See below for more info on donating specific types of gifts and options for your giving.

Donating gifts of stock

Follow these steps to donate gifts of eligible securities to a fund at CRCF:

- Sign a Letter of Authorization to your broker with the following infomation:

- Number of shares and name of stock to be gifted

- Your (the donor's) name

- Your account number and account name

- FBO (for the benefit of) the Cattaraugus Region Community Foundation

- **Contact CRCF for DTC number and account number

**Please always notify the Foundation of your intent to donate stock and to which fund so we can confirm the transfer to the appropriate fund and provide you with an acknowledgment and tax receipt when the electronic confirmation is received.

Donating an IRA Charitable Distribution

Why make an IRA Charitable Distribution?

The IRA QCD provision can help to bolster your legacy of giving while reducing your taxable estate.

Traditional and Roth IRA owners who are age 70½ or older can still make a charitable contribution of up to $100,000 per year directly from their IRAs to an eligible organization, like the Cattaraugus Region Community Foundation (any fund at the foundation qualifies) and enjoy some tax advantages.

The distribution counts for the purposes of the Required Minimum Distribution (RMD) from IRAs, but is not included in calculating the individual taxpayer’s limitation on charitable deductions in the year the donation was made. While the donor would not receive a charitable deduction for a transfer from his/her IRA to a charity, the amount of the transfer would not be included in his/her gross income, nor would it be subject to income tax.

How to donate an IRA Charitable Distribution:

- Communicate with your IRA’s custodian (where your IRA is held) that you are interested in making a Qualified Charitable Distribution (QCD)

- Make the request for the QCD in writing.

- Specify the dollar amount that you wish to contribute.

- Request the check be made payable to CRCF and note the fund you would like to support.

- Provide CRCF's EIN: 16-1468127 (Note: CRCF may also be listed as the Greater Olean Community Foundation, CRCF is the DBA).

- Provide CRCF’s mailing address to our custodian: 301 N. Union St., Suite 203, Olean, NY 14760 and request a receipt for your records. CRCF also will provide you an acknowledgment/tax receipt.

- Maintain the receipt(s) and records in your tax file.

- Report the QCD amount on your 1040 federal tax return.

- Enter the total amount(s) on line 4a of your 1040 federal tax return.

Foundation-related info you may need

For your convenience, please note the following info you may need in order to make a donation to CRCF.

EIN: 16-1468127

Legal Name: Greater Olean Area Community Foundation

DBA: Cattaraugus Region Community Foundation

If you are searching for the Cattaraugus Region Community Foundation (DBA) in a database as the destination charity for your gift and cannot find it, search for the Foundation's legal name "Greater Olean Area Community Foundation"

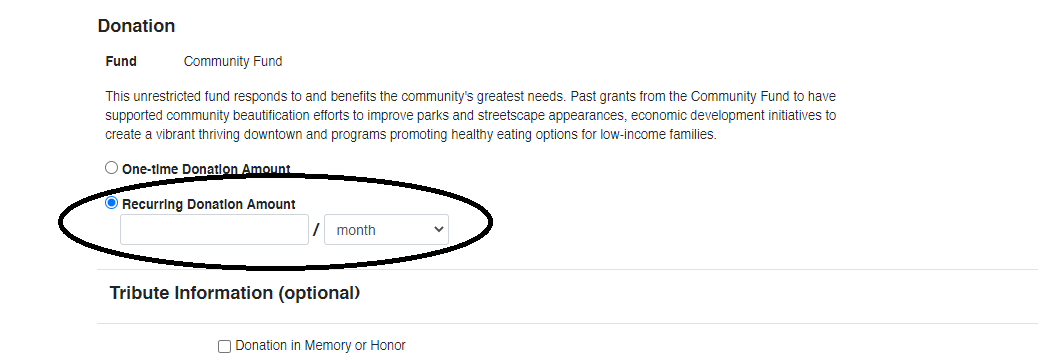

Monthly Giving

You also have the option to become a monthly giver with a recurring donation through the Foundation's online giving system. When making a donation, simply select recurring donation and choose the frequency of your recurring donation. It is an easy way to make a continuing contribution to the fund of your choice. The donations will be posted with no action required from you!